Key investment implications:

In a nutshell

Find out more

- Growth is heterogeneous, but no recession is expected. Spending and investment may pick up over the semester as trade uncertainty eases and interest rates decline.

- Europe is the most attractive developed market region in terms of shareholder remuneration, through increased share buybacks and dividend payments.

- Diversification* from US equities benefit European stocks. Concerns over trade tensions and government spending have prompted investors to seek alternatives outside of US markets. However, varying levels of trade exposure to the US and China can be noted. Ireland is the most dependent on exports to the US, followed by Belgium, Slovakia, Germany and the Netherlands.

- The euro’s recent appeal as a safe haven could encourage portfolio adjustments in favour of European debt amid increasing volatility in USD bonds.

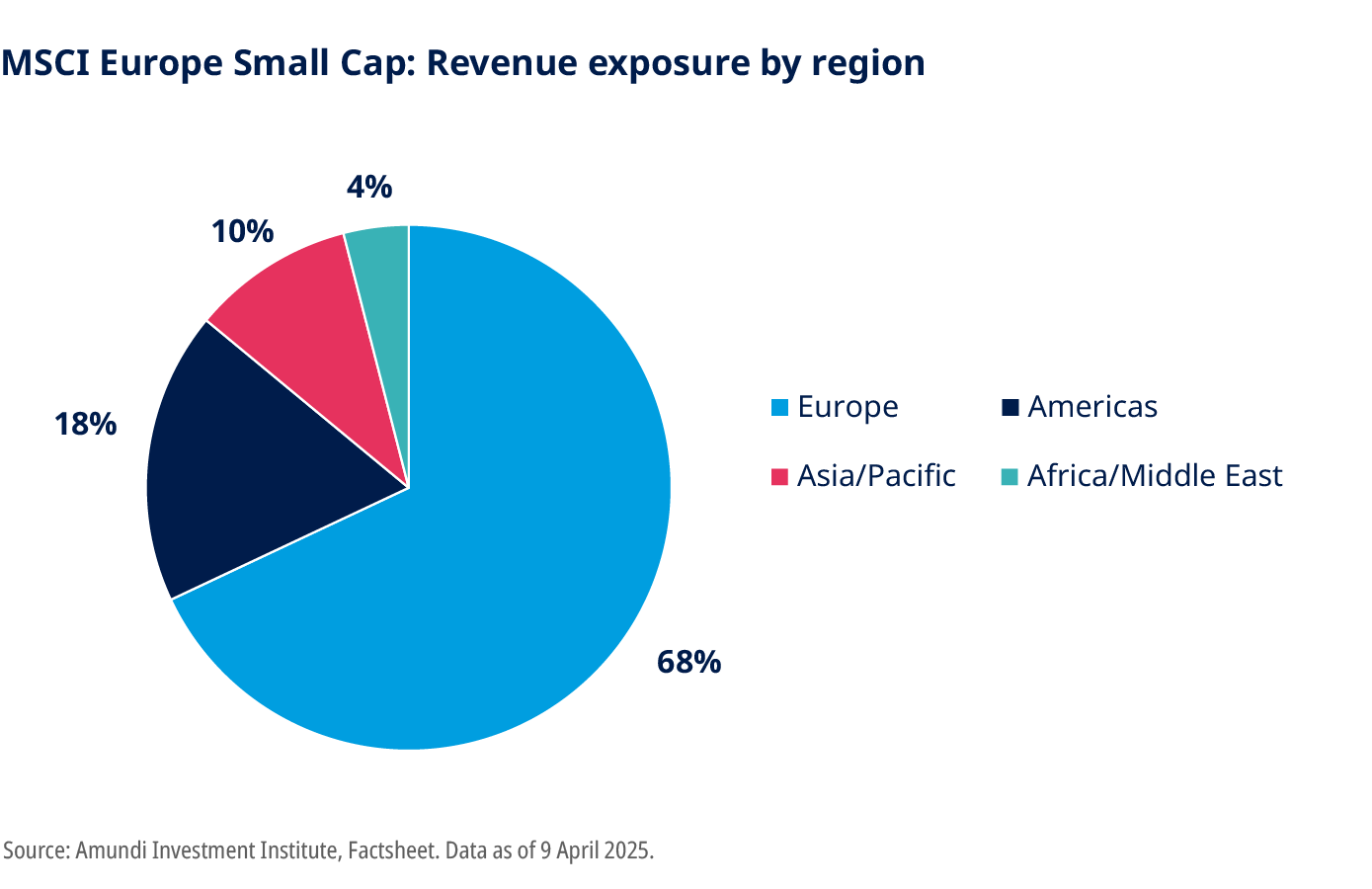

- European mid and small-caps are particularly attractive due to appealing valuations. They should benefit from further interest rate cuts and stronger domestic spending. SMIDs also offer portfolio diversification, as they tend to behave differently from large-caps throughout economic cycles.

- Key long-term growth drivers for European markets include AI, decarbonisation, infrastructure and defence.

- Europe offers stability for investors. Households maintain strong spending power and high saving rates. Credit risk has improved (especially in Greece) and inflation is easing across the Eurozone, which should give the European Central Bank room to further cut interest rates.

- Government debt remains elevated, similar to other regions, and some countries could face spending constraints.

- European bonds provide appealing returns, even though spreads on 10Y government debt remain low. The current environment favours European corporate bonds, particularly in the high-grade segment.

- The euro has gained appeal as US bond investing becomes more volatile. This could encourage investors to shift towards European bonds.

Upcoming reforms and investment plans aimed at achieving strategic autonomy are transforming Europe into an increasingly attractive destination for investors, supported by a stronger euro. Equity valuations are relatively appealing, especially among small caps; government bonds may benefit from a favourable growth and inflation mix; and credit supply and demand appear balanced, with the financial sector expected to outperform.

See our offer

Amundi Funds Euro Aggregate Bond

Amundi Funds Euro Corporate Bond Select

Amundi Funds Europe Equity Income Select

Amundi Funds European Equity Small Cap

Amundi S.F. - Diversified Short-Term Bond Select

Amundi Core EUR Corporate Bond UCITS ETF

CPR Invest - European Strategic Autonomy

Amundi Core Stoxx Europe 600 UCITS ETF

Amundi STOXX Europe Defense UCITS ETF

Read our news and insights

Discover our Convictions themes

*Diversification does not guarantee a profit or protect against a loss.

Source: Amundi Investment Institute, Mid-Year Outlook - Ride the policy noise and shifts, June 2025; Amundi Investment Institute, Time for Europe, June 2025.

Marketing material for professional investors only

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of September 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: September 2025

Doc ID: 4744936