Equities in the global trade rewiring

In a nutshell

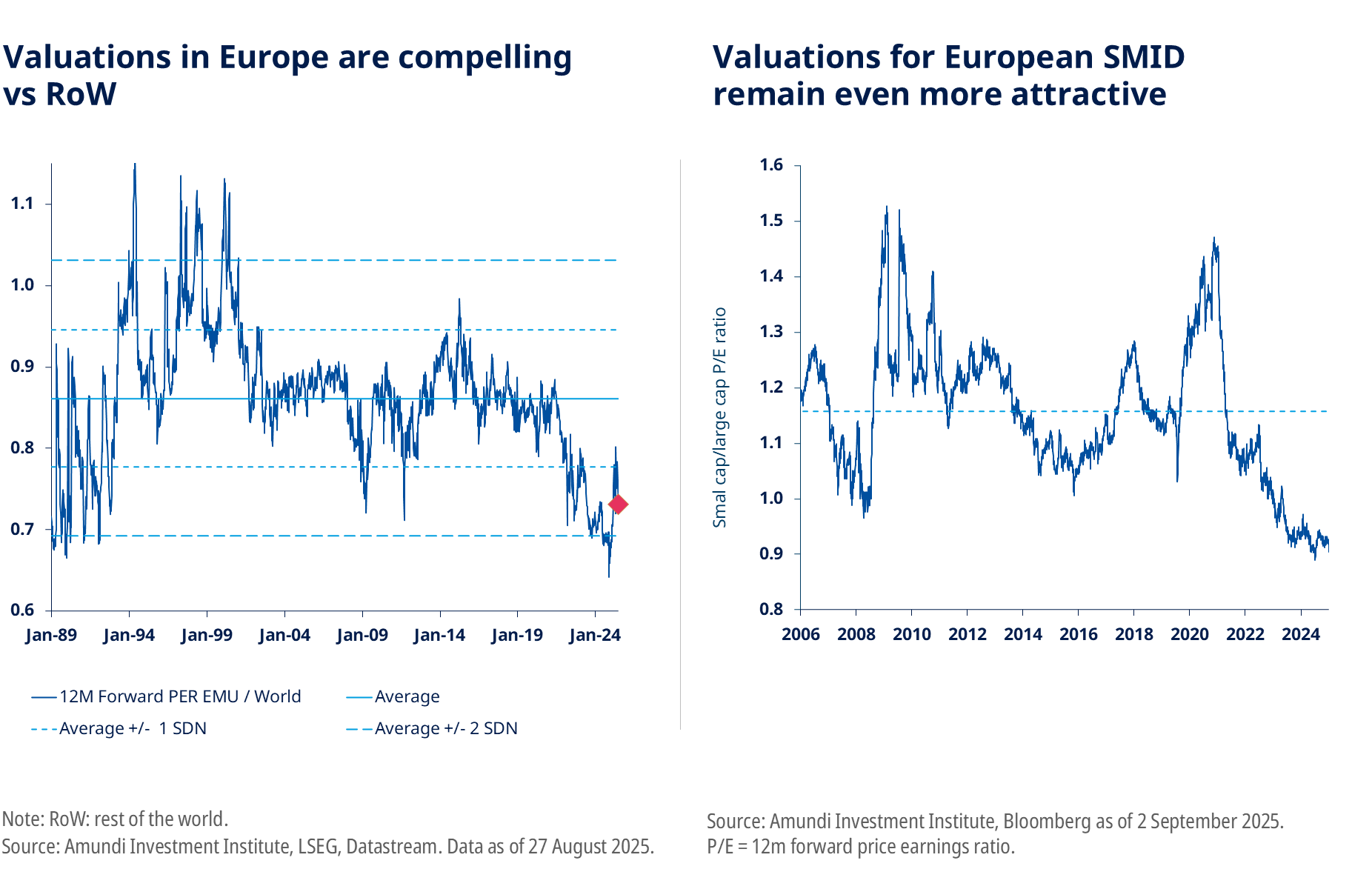

Despite unpredictable policymaking, business resilience, and the reorganisation of global trade and financial systems, the expected rate cuts from central banks will create opportunities in global equities. We are focusing on themes such as European defence spending, US deregulation, corporate governance reform in Japan, and the ‘Make in India’ initiative.

*Diversification does not guarantee a profit or protect against a loss.

Source: Amundi Investment Institute, Mid-Year Outlook - Ride the policy noise and shifts, June 2025.

Marketing material for professional investors only

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of September 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: September 2025

Doc ID: 4744936