CPR Asset Management

Amundi ETF

Amundi Real Estate

- Home

- Hunkering down to reach Net Zero

Decarbonisation

Hunkering down to reach net-zero?

Targeting all sectors with all means available is the only way to achieve full-scale decarbonisation, says Gauthier Saint Olive, investment specialist at CPR AM.

Investments in low-carbon technologies and renewable energy have soared to unprecedented heights in recent years.

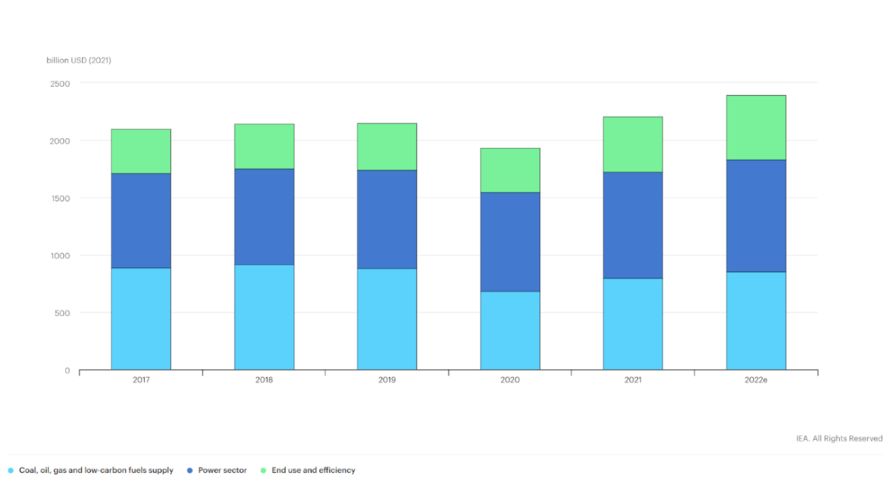

Energy investment is set to pick up by 8% in 2022 against the global energy crisis, according to the International Energy Agency’s World Energy Investment 2022 report1.

Global Energy Investment, 2017-2022

Source: International Energy Agency, World Energy Investment 2022, as at June 2022

We want to give people a choice of how they can invest responsibly, and that comes down to making sure the necessary range of products is available. Putting that into practice means we have to systematically integrate ESG criteria, wherever it is feasible, in our investment processes, and to constantly innovate to find new ways of broadening the Responsible Investing spectrum.

Energy systems of the future will be built around a blend of low-carbon solutions. Low-carbon solutions include renewables like solar, onshore and offshore wind, as well as biofuels and net-zero hydrogen, said Gauthier Saint Olive, investment specialist at CPR AM. Low-carbon investments target a gradually decarbonised economy with carbon efficiency in all sectors. All sectors – especially the most polluting ones – need to decarbonise2.

‘We need all sectors, we need all countries to achieve a global low carbon economy,’ Gauthier said.

Investments in renewable energy, on the other hand, target the development of clean energy sources like wind farms and solar panels to replace fossil energy. For example, we cannot replace the oil used for transportation by solar. The main goal is to have instant, low carbon energy production.

We do not target [only] carbon-free sectors, but all industries... The main objective, climate-wise, is to align the carbon emissions of the portfolio with the Paris Agreement.

Gauthier Saint Olive, Investment Specialist, CPR AM

Though these two approaches may be different, both serve the same objective – the fight against climate change. ‘It’s about limiting the temperature increase but in different ways, with a different approach,’ Gauthier said.

A low-carbon future

The pandemic had a major impact on energy systems around the world and it led to an increased uptake of low-carbon strategies in Amundi’s case.

‘Amundi has seen large inflows in low-carbon strategies since the beginning of the pandemic, both from the retail and the institutional side,’ Gauthier said. ‘Most of the Requests For Proposals (RFPs) we receive from the institutional investor now embed a climate impact aspect.’2

Discover more about Impact Investing

Sources:

1

https://www.iea.org/reports/world-energy-investment-2022

, as at June 2022

2 Interview with Gauthier Saint Olive on 6/4/2022; see transcript

IMPORTANT INFORMATION

Unless otherwise stated, all information contained in this document is from Amundi Ireland Limited and is as of 17 October 2022. The views expressed in this page should not be relied upon as investment advice, a security or service recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results. Amundi Ireland Limited is authorized and regulated by the Central Bank of Ireland.

Date of first use: 17 October 2022

Doc ID: 2915705