Market Returns: What to expect in the next decade

April 2023 | 2 min read

What to expect in the next decade

Key Takeaways

• Actions against climate change are uncoordinated, leading to a “disorderly” transition towards net zero

• Social costs of climate change will play a relevant role

• Bonds are back after a decade, retaking their role of portfolio diversifiers

• Emerging market equities and alternative assets may help boost returns in a diversified portfolio

Climate change is the main challenge on top of policymakers’ minds around the world. Even if some global initiatives exist (such as the United Nations Framework Convention on Climate Change1), governments are approaching the problem in an uncoordinated way, leading to what we could define as a “disorderly” transition towards net zero.

As a global transition to renewable energy will take time, we expect prices of fossil fuels to increase in the near term, leading to higher inflation and lower productivity. Central banks will probably be cautious in reducing the size of their balance sheets, which we predict will stay above pre-Covid levels, but will continue to hike interest rates to fight inflation. Furthermore, we expect central banks to act as a catalyst in addressing climate change, and that the sectors closely associated to the energy transition will be the biggest beneficiaries of policymakers’ support.

The social costs of the energy transition will have to be considered. As new technologies and jobs will emerge and replace old ones, consumers’ behaviours will also change. The climate transition will present both risks and opportunities: a more inclusive growth model may come out, and increased wages may compress companies’ profit margins, but will likely boost household consumption

New legislation supporting the energy transition will affect emerging and frontier economies the most, while developed countries will react by diversifying the composition of their exports. Investment plans will have to support the phasing-out of fossil fuels especially in sectors where their legacy is the strongest.

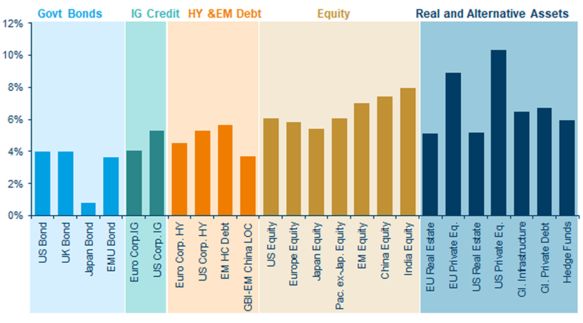

Looking at equities, we see opportunities coming from Chinese and Indian stocks. The current leaders of the green transition will be favoured by this shift, while the US remains the first choice among developed markets. In terms of sectors, we prefer IT and we keep a positive outlook on value investing.

Bonds, after almost a decade, are coming back on the scene, retaking their role as a potential portfolio risk diversifier*, but we foresee higher volatility and a weaker economic outlook. Emerging markets bonds could provide higher yields, but they bear a higher default risk.

Alternative assets could help in building an inflation-resistant portfolio. In our view, private equity, in the US in particular, should lead the way in terms of expected returns, while global private debt should be favoured on a risk-adjusted basis. We identify hedge funds as having the lowest level of risk among alternative assets. On the other hand, real estate and infrastructures are vulnerable to the impact of climate-related events. For instance, rising sea levels could inundate ports and other coastal infrastructures, while changing patterns of storms may lead to economic losses due to power outages and negatively impact distribution networks2. However, such investments are appealing in terms of portfolio diversification*, and this may be the key to targeting superior returns in a high-risk environment.

10-year expected returns

Source: Amundi CASM Model Data as of 30 December 2022

To learn more, visit our Research Center:

Sources:

Amundi Institute, A rocky net zero pathway, 28 March 2023

1 https://www.oecd.org/environment/cc/policy-perspectives-climate-resilient-infrastructure.pdf

2

https://unfccc.int/

(*) Diversification does not guarantee a profit or protect against a loss

Important information

Unless otherwise stated, all information contained in this document is from Amundi Ireland Limited and is as of 28 April 2023. The views expressed in this page should not be relied upon as investment advice, a security or service recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results. Amundi Ireland Limited is authorized and regulated by the Central Bank of Ireland.

Date of first use: 28 April 2023

Doc ID: 2885014