Ride the policy noise and shifts

A rewiring of the global economy is forcing investors and policymakers to exercise caution. Uncertain policymaking is causing significant market volatility. Nevertheless, major economies have demonstrated resilience thus far.

7 key convictions for H2 2025

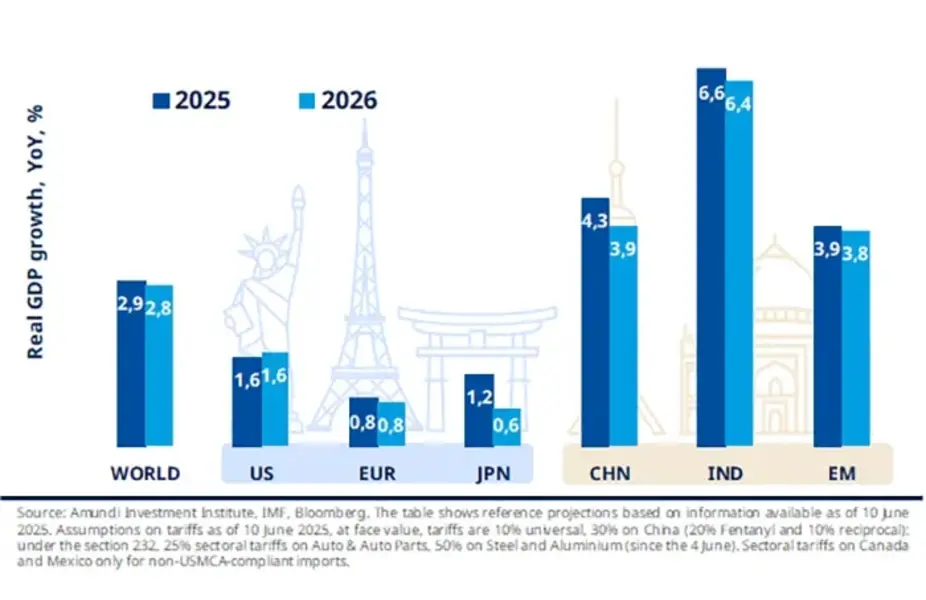

We anticipate US real GDP growth to decelerate from nearly 3% in 2023–24 to 1.6% in 2025, mainly driven by weaker private demand. Rising tariffs will push up prices, dampening consumer confidence and spending, while uncertainty is expected to weight on investment. Although fiscal policies and deregulation might provide some support, their effects are likely to be limited. With average tariffs projected at around 15% (based on our base case), economic losses and a temporary uptick in inflation are expected. In response to the slowing growth, the Fed is forecasted to cut interest rates three times in the second half of the year.

We are currently facing a more contentious geopolitical landscape, with the US administration contributing to rising tensions through tariffs and scaling back commitments to European security. This may further unite Europe, as leaders recognize the advantages of collective negotiation while pursuing new trade agreements to diversify their trading partners. The US–China relationship is expected to worsen, although both countries will likely aim to avoid escalation. In this context, the trend of diversifying away from US assets is expected to persist, with a particular preference for European assets.

Despite the subdued growth outlook, we do not expect an earnings recession, as businesses continue to show resilience. This, combined with the Fed’s anticipated rate cuts, supports a cautiously optimistic asset allocation with a focus on inflation protection. We favour global equities with a focus on valuations and pricing power, alongside commodities, gold, and hedges against growth and inflation risks stemming from a geopolitically uncertain world. Infrastructure investments offer the potential for stable cash flows, while currency diversification will be crucial amid shifting correlations between the USD, equities, and bonds.

Investors will require a higher premium for US Treasuries amid uncertainty over trade policies, rising public debt, and a substantial bond supply. In developed markets, long-term yields are expected to remain under pressure. Central banks cutting rates will continue to support short-dated bonds, contributing to a steeper yield curve. Investors will seek diversification across markets, favouring European and emerging market debt. We recommend maintaining exposure to quality credit, with a preference for euro-denominated investment grade, particularly financial and subordinated credit.

Equities may deliver low single-digit returns in the second half of the year, with ongoing rotations expected. Europe’s appeal is likely to become a structural theme, benefiting small- and mid-cap stocks, where valuations remain highly attractive. Globally, sector selection will be key. We favour domestic and service-oriented sectors to mitigate tariff risks, focusing on themes such as US deregulation, European defence and infrastructure, and the ongoing reforms at the Tokyo Stock Exchange, which are fostering a more investor-friendly environment in Japan.

Emerging market equities will be favoured in H2 2025, supported by recovering macroeconomic momentum and stabilizing inflation. As US exceptionalism wanes, India and ASEAN are emerging as key beneficiaries of global supply chain rerouting. India’s “Make in India” initiative is attracting multinational corporations, especially in defence and IT. With a focus on domestically oriented sectors, these markets are not only manufacturing hubs but also dynamic growth engines, well-positioned to capitalize on structural shifts and expanding consumer bases.

Extra selectivity is essential given the surge of capital flowing into these segments. Overall, a challenging geo-economic environment will enhance the case for diversification* through private assets, benefiting resilient domestic opportunities. Private debt and infrastructure are expected to remain the most attractive areas. Private debt may gain from robust direct lending and fundraising activity, while infrastructure will continue to appeal to investors seeking inflation protection.

Global growth outlook

Economic growth will depend on the path of tariffs following the 90-day pause and the implementation of Trump’s policies. Ongoing policy uncertainty and its impact on domestic and investor confidence remain key risks to monitor.

Investment themes to keep an eye on

Latest News

Webinar playback: Mid-Year Investment Outlook 2025

Mid-year Investment Outlook 2025

*Diversification does not guarantee a profit or protect against a loss.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 26 June 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 26 June 2025

Doc ID: 4614222