- Home

- Strategies

- Fixed Income

- Alpha Fixed Income

Amundi's Alpha Fixed Income offer

Amundi's broad expertise, which spans all fixed income markets, allows to continually seek out the best opportunities for our clients. The size and structure of these markets continue to evolve, offering new ways for investors to source potential returns.

4 reasons to partner with Amundi for Alpha Fixed Income strategies

|

Unique market coverageMore than 200 professionals, providing a broad coverage of the global bond markets. Through several investment centers around the world, our teams also benefit from a global and collegial investment culture. |

|

Integrated Investment platformA global platform integrating Risk Management, Trading, Research and Portfolio Management capabilities, offering a deep quality of service to our clients. |

|

Robust and comprehensive risk managementContinuous monitoring from the front-office to operations: it includes liquidity simulations with regards to different market conditions and traded volumes for capacity estimated by the dealing desk for each kind of instrument. |

|

Sound liquidity policyAmundi's experienced trading team and its diversified network of brokers provide a privileged liquidity access: low trading costs and consistent primary allocations. |

The Alpha Fixed Income range in a glimpse

Governement Bonds

Amundi’s wide and proven expertise in this field, especially in euro and global government bonds showing a 40-year track record, aims to serve the best dynamic allocation. Our investment teams combine long-term macro views with short-term tactical management to benefit from the main opportunities of the markets, in different economic cycles. This core expertise includes euro and global strategies drawing on the crucial skills of local investment teams.

Corporate Bonds

The Investment Grade and High Yield markets developed significantly since the introduction of the single currency in 1999. Amundi's Corporate Bonds strategies are led by stable and experienced teams working closely with dedicated strategists and credit analysts. Since inception, the teams developed new solutions including, low duration strategies, ABS, subordinated debt, unconstrained strategies, rule-based strategies and credit continuum strategies.

Aggregate Bonds

Amundi has developed strategic global, US and euro bond expertise which spans a broad universe: bonds, investment grade credit, high yield, ABS, convertible and inflation-linked bonds, currencies and emerging bonds. With the aim of seeking out value wherever it exists, our investment teams implement dynamic asset allocation built around our large investment toolbox and supported by our long-standing expertise in aggregate strategies, which are regularly recognized by rating agencies, such as Morningstar and Lipper for both their innovation and top-quality management.

Our Absolute Return Expertise

Amundi’s Absolute Return Fixed Income platform is designed to address the challenges facing investors in the fixed income markets today. An increasingly difficult environment, including heightened rates volatility, means investors must re-think their approach to fixed income investing, beyond the ‘traditional’ sense.

Our commitment to our clients is twofold: to provide an extensive range of global, and flexible, investment solutions that address these challenges by delivering strong risk-adjusted returns with an unwavering focus on capital preservation, and providing a best-in-class experience in the Absolute Return fixed income space.

Our Approach

Amundi’s Absolute Return Fixed Income methodology combines a disciplined and transparent investment process with a strict downside risk management framework. Access to a broad investable universe enables us to identify numerous uncorrelated alpha opportunities across a wide range of markets and horizons and allows us to build diverse portfolios that have low to negative correlation with traditional asset classes. We actively avoid biases and reliance on a single source of return in order to maximize investment opportunities. We harness the breadth of research and asset class expertise within Amundi to build our macro view of the world and use that framework to dynamically manage the beta risk in our portfolios based on our level of conviction and expectations for future volatility.

Our Team

Amundi’s absolute return investment team is global, with members across multiple Amundi investment offices, and integrated within the wider fixed income platform. The team is made up of likeminded and collaborative individuals who share the same investment philosophy, principles, and commitment to our clients.

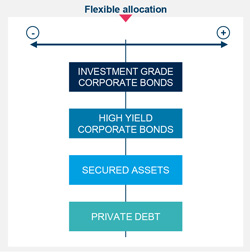

Combine the best credit opportunities

Our capabilities allows to re-allocate among credit sectors and sub-segments provides increased robustness of portfolios in times of uncertainty.

Our strategies are backed by our stable and experienced Credit Analysis Team - one of the largest in Europe, covering US, Emerging and Developed markets. Their top quality research and analysis supports investment teams in designing the most optimal allocation according to the prevailing bond & credit market conditions.

Committed to offering the widest scale of opportunistic solutions, Amundi has refined investment process behind US Fixed Income. A dedicated investment team is implemented locally, including 8 Senior FI Portfolio managers with an average of 25 years of industry experience. This team manages an extended spectrum of assets, backed by sector specialists: liquid markets, securitized credit and corporate credit professionals. It focuses on security selection and sector rotation and implements a consistent investment approach across multiple U.S. fixed income sectors, combining proprietary quantitative valuation tools with in-depth fundamental investment analysis and market experience to identify attractive sectors and securities.

Our established platform is renowned for its long-standing expertise in institutional Fixed Income strategies:

- Multi-Sector Fixed Income: core fixed income strategies & US treasuries, including total return to boost return potential

- Asset-Backed Strategies: from high credit quality to agency mortgage-backed securities and securitised credit to obtain a high level of current income and reduce interest rate risk

- Credit Strategies: relative value, global or US high yield, corporate credit allowing to invest in Investment Grade and High Yield as well as mortgage-backed securities and emerging markets corporates.

|

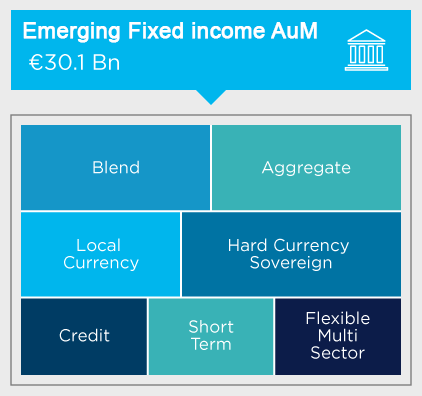

Amundi applies an integrated and research led approach to investing in emerging markets, looking across equity and fixed income. Understanding government bonds markets enables a better understanding of growth and inflation. Rates help us understand systemic risk. Credit and equity markets are symbiotic but not always efficient. Understanding the full cost of capital creates opportunity. Our strategies:

|

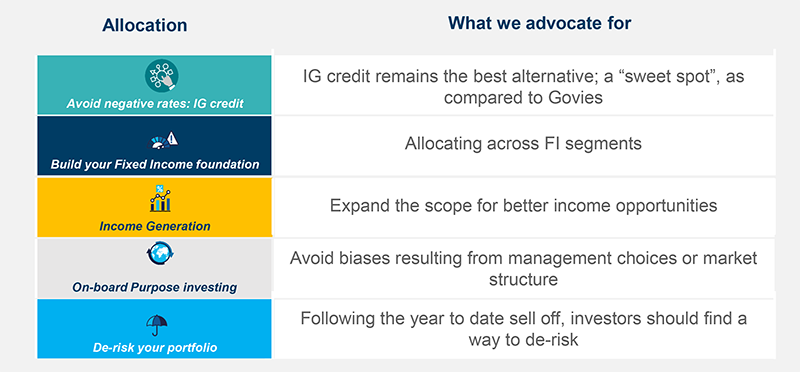

Fixed Income Allocation

Amundi offers a comprehensive range of solutions addressing the recurring needs of our investors.

Amundi's teams offer structural and tactical strategies for all allocation purposes.

Learn more

Fixed Income

Amundi's Fixed Income teams provide solutions that help investors build a better financial future. Over time, we have provided investors with flexibility and choice through expanding our global investment capabilities to cover most of market segments from Govies, High Yield Bonds to Loans.

ESG Fixed Income solutions

Amundi plays a premium role in designing a SRI and green bonds offering for her clients.

This information is exclusively intended for “Professional” investors within the meaning of the MiFID Directive 2004/39/EC of 21 April 2004, and articles 314-4 and following of the General Regulations of the AMF. It is not intended for the general public or for non-professional individual investors within the meaning of all local regulations, or for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act.

This non-contractual information does not under any circumstances constitute an offer to buy, a solicitation to sell, or advice to invest in financial instruments of Amundi or one of its affiliates (“Amundi”).

Investing involves risks. The performance of the strategies is not guaranteed. In addition, past performance is not in any way a guarantee or a reliable indicator of current or future performance. Investors may lose all or part of the capital originally invested.

There is no guarantee that ESG considerations will enhance a fund’s investment strategy or performance.

Potential investors are encouraged to consult a professional adviser in order to determine whether such an investment is suitable for their profile and must not base their investment decisions solely on the information contained in this document.

Amundi assumes no liability, either direct or indirect, resulting from the use of any of the information contained in this document, and shall not under any circumstances be held liable for any decisions taken on the basis of this information. This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of Amundi, for any third person or entity in any country or jurisdiction which would subject Amundi or any of its products to any registration requirements within these jurisdictions or where this might be considered unlawful.

This information is provided to you based on sources that Amundi considers to be reliable, and it may be modified without prior warning.